Founded in 2010 in the United States, Miiori expanded to Europe in 2011 and branched out into Asia during the last few years. Currently they have representative offices in Hong Kong, New York, Ibiza, Madrid and Moscow. Realising the difference in each market, the brandŌĆÖs approach in adopting tailored strategies in Asia proves to be a right move as their sales in Asia Pacific is surpassing both the United States and Europe combined. Furthermore, in the Asian market, only five percent of their revenue is spent on promotion, compared to 20 percent in the States and Europe, according to Marc De Vries, commercial director Asia Pacific of Miiori.

In the US and European markets Miiori followed a traditional mode of marketing such as celebrity endorsement. In contrast, their branding in Asia is not in the same way, and most of their promotion efforts are related to income generating opportunities rather than a long-term brand-building exercise, said De Vries to Hong Kong Jewellery.

Citing Hong Kong as an example, he pointed out that the luxury market is saturated with established jewellery brands so they would not be able to make much profit with above-the-line advertising. Another factor is that retailers in Hong Kong prefer to sell under their own name instead of carrying a branded product. Despite that their main target clients are high-end retailers, he noted that ŌĆ£the role of retailer is becoming more and more of a challenge with pressure on margins and the increasing online sales for jewellery in general.ŌĆØ Therefore, after working with retailers such as Lane Crawford for a period without satisfactory results, they recently switched to an alternative approach by engaging private consumers directly in both Hong Kong and mainland China.

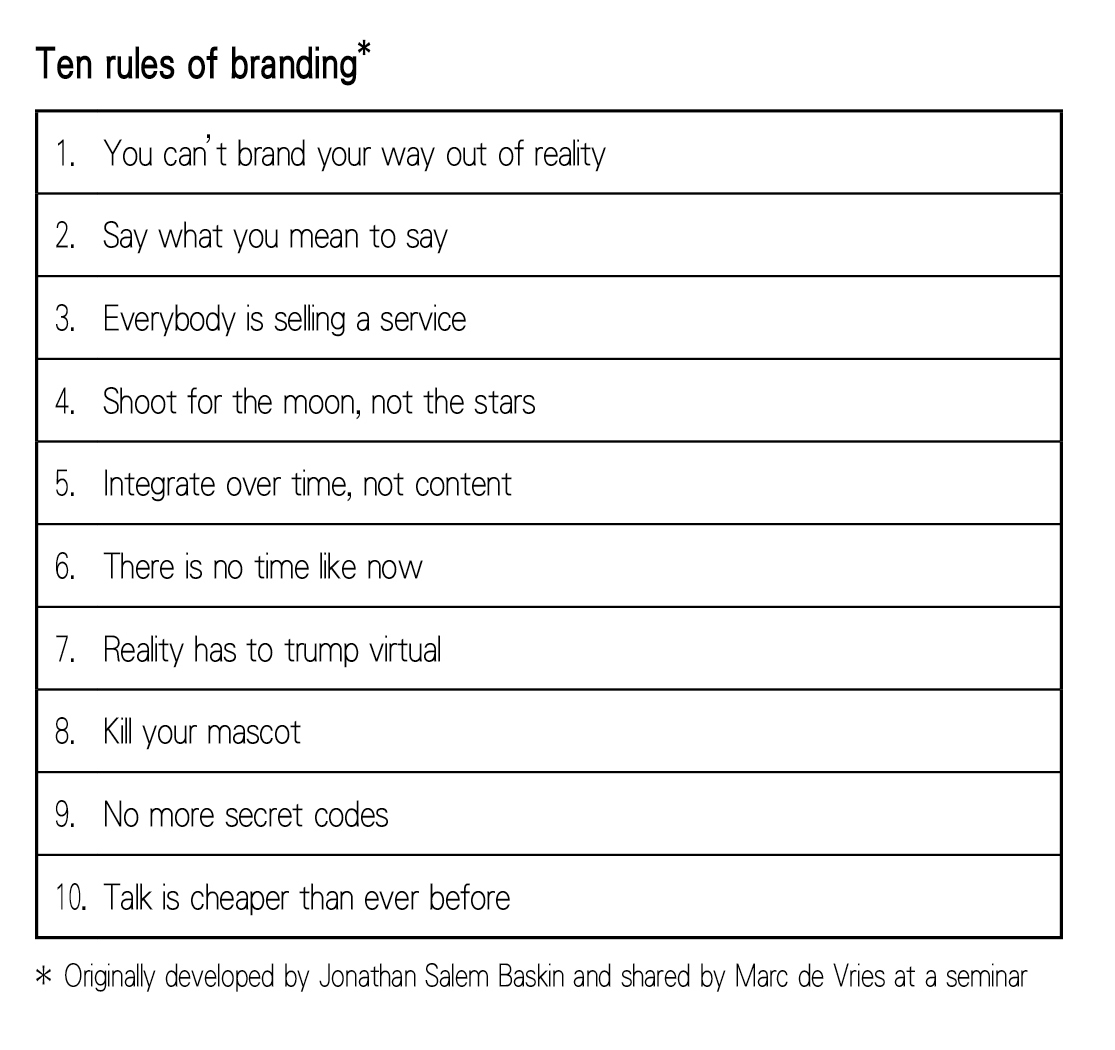

De Vries stressed that whether in trade or retail, customersŌĆÖ experience in purchase is key to solidifying their brand image. Thus the brand placed great emphasis on direct customer interaction by organising private events and engaging in sponsorship campaigns such as concerts and film festivals. Focusing on small, dedicated groups instead of the public, the brand makes sure that they are marketing towards the right audience. One important point to note is that in these occasions they always offer actual buying opportunities so that clients will eventually expect and even develop a responsibility to buy from them in such events. The underlying rationale is that they think brands should focus on addressing clientsŌĆÖ needs at the moment instead of selling a promise in the future as future benefits might not be within the purview of current branding strategies.

To reach the right customers, Miiori works with a network of business partners including VIP clubs and banks in the local markets on a performance basis, which has effectively reduced their out-of-pocket expenses. In comparison, the traditional model requires considerable investment before any direct monetary benefit can be produced. Nevertheless, De Vries admitted that finding the right partners is not easy and considerable time is spent in the process.

In Asia, Miiori is only present in selected markets including Hong Kong, Macau, the Philippines, mainland China, Indonesia and Malaysia. According to De Vries, such selection is a reflection of market opportunities for coloured gemstone fine jewellery and the ease for them to enter these markets. ŌĆ£We prefer to be a big fish in a small pond, rather than the other way round,ŌĆØ he said. Therefore the brand decided to be present in smaller markets like Penang, Malaysia. In China, they limit their efforts to Shenzhen for the moment, since they plan to consolidate their position in an existing market before moving on to a new one.

Like many jewellery brands, Miiori is nonetheless facing challenges posed by the global economy in addition to the strengthening of the US dollar. De Vries expects ChinaŌĆÖs slowdown to affect all Asian markets as it will influence buying sentiment. The European and the US markets are shifting towards lower price points. Although there are similar developments in Asia, at the high-end, there is still demand for unique pieces so prices of the most exclusive items did not go down. In his view, it is due to the scarcity of high-quality, untreated rubies, sapphires and emeralds that drives prices. He also suspected that volatility in the stock markets helps divert some money towards investment in fine jewellery. Besides, lowering gold and other material costs will encourage purchase for low- and mid-level priced products, so they remain optimistic about increasing their revenue and gaining market share in the future.